At Harava, we’re proud of the positive impact we have on companies we invest in and those who entrust us with their capital. We are guided by our core values and principles which defines our character and culture and serve as a fundamental strength of our business. As capital allocators and value creators, our clients’ and/ investors’ interest are the center of everything we do.

We scan the market for opportunities for our investors and clients. Our investment approach is based on disciplined due diligence process that measures risks while identifying the opportunities for increased value.

The Fund

Our Fund focus on identifying and developing the next generation of high-growth MSME companies to achieve risk-adjusted returns for its investors. The team will make growth equity investments in companies that conduct a material portion of their business operations in the Washington D.C, Maryland, Virginia (DMV) and/or Mid-Atlantic regions. The target sectors of the Fund include Real Estate Services, Trade & Commodities, Manufacturing & Industrial, Healthcare, and Technology and technology-enabled services, Clean Energy. The minimum investor commitment into the Fund is $250,000 or an amount approved by the Fund Manager.

We prefer to invest in companies with recurring revenue that is recession resistant; highly motivated management team, with loads of integrity and talent, and strong sustainable advantages, among others.

Background

MSME firms with fewer than 500 employees, are the backbone of U.S. economy. They make up 99% of all firms, employ over 50% of private sector employees, and generate 65% of net new private sector jobs. SMEs account for over half of U.S. non-farm GDP, and represent 98% of all U.S. exporters and 34% of U.S export revenue.

American Business is Overwhelmingly Small Business

According to data from the Census Bureau’s Annual Survey of Entrepreneurs, there were 5.6 million employer firms in the United States in 2016.

Bulk of Job Creation Comes from Small Business

According to the SBA’s Office of Advocacy:

In addition, in its 2018 Small Business Profile of the United States, the SBA’s Office of Advocacy reported:

Small Business Share of Employment

According to data from the Census Bureau’s Annual Survey of Entrepreneurs:

The Small Business Share of GDP

A January 2012 report from the SBA’s Office of Advocacy found:

“Small businesses continue to be incubators for innovation and employment growth during the current recovery. Small businesses continue to play a vital role in the economy of the United States. They produced 46 percent of the private nonfarm GDP in 2008 (the most recent year for which the source data are available), compared with 48 percent in 2002.”

Source: “Small Business GDP: Update 2002-2010”

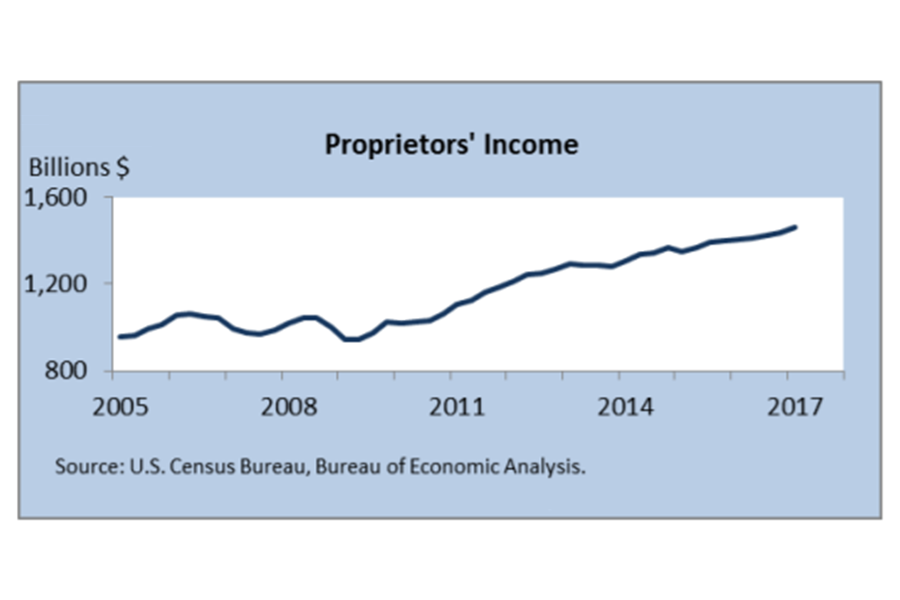

The above figure depicts the trend in U.S Small Business Proprietors’ income, the yields for running small businesses (excluding corporations), which has been steadily increasing over the last 7 years and is pegged at over $1,500 billion in 2017. This clearly illustrates the growing importance of small businesses to the U.S economy and the immense potential that could be harnessed by investing in such enterprises.

However, MSMEs consistently report higher financing hurdles than large enterprises given their size, relatively limited assets and general inability to raise funds through credit markets or publicly traded equity. Also, from the many years of experience that the Partners of Harava Group, Inc have had in engaging with MSMEs, we have seen first-hand that facilitating access to risk capital and business assistance can empower a company to overcome impediments to its growth and lead to production of higher value-added products or services.

Investing in MSMEs

The Harava SME Fund One aims to bridge this gap. We have observed a significant number of MSMEs with strong business fundamentals, but facing an undercurrent of strategic, operational, technological issues restricting or delaying their growth trajectory. Through capital infusion and providing business advisory services, Harava SME Fund One enables companies to take advantage of market access opportunities and forms long-term partnerships.

We strongly believe that the dislocation in financing channels alongside the Principals’ proven capabilities to provide growth strategy and business advisory services offers an opportunity to achieve attractive risk-adjusted returns. The ramp-up in profitability of the enterprises will lead to sustainable growth, which will position the businesses as attractive targets for strategic industry players and provide an exit through trade sale for the Fund.

Sectors

Potential Pipeline Opportunities

The below table illustrates the potential pipeline opportunities and the projected growth in revenue through appropriate level of capital infusion and continuous portfolio engagement.

Sector Description Rationale for Investment Potential Returns

Year 5

A.) FintechMobile-to-mobile remittanceDisruptive remittance model well-suited for target markets35-40%

B.) InfrastructureConcrete services & repairsProven record of consistent cash flows with scope to grow20-25%

C.) HealthcareHome Care AgencyLong operating history with strong and diversified client base15-20%

D.) Real Estate ServicesMulti-family HousingPotential for steady annual cash flow with long-term appreciation18-20%

E.) TechnologyIT SolutionsStrong revenue with high margins through secured long-term contracts35-40%

F.) IFMIntegrated Facility ManagementGreat management team, strong cash flow, strong EBITDA30-40%

The Fund will have a well-defined investment thesis which will act as a guiding tool to clearly identify sources of returns for the Fund as well as investors, while also ensuring that the investment team stays focused and disciplined.

· Cash Interest: Annual cash interest of 12-15%

· Leverage: The Fund plans to prudently deploy leverage (subject to strict cap restrictions) on a deal-to-deal basis when deemed appropriate to enhance returns

· Ownership: Through appreciation in value of ownership stake

· Value-added Services: The Fund will secure an arrangement with its portfolio companies to monetize for the value-added services provided

Fund Management & Risk Mitigation

As an organization that strongly believes in transparency and robust investor protection, the Fund will have rigorous risk management practices designed to provide comfort to investors and all stakeholders throughout the life of the Fund, including the below:

A.) Trust Fund Account: The Fund will have in place a Trust Fund account to securely accept and route investor money before the Fund Manager could draw capital for deployments in portfolio companies.

B.) Audit & Review: The Fund will also have an internal structure that mandates a compulsory audit and periodic review of the accounts to provide effective monitoring and disclosure to investors.

C.) Risk Management: The Fund will aggressively manage its risk exposure, building on the team’s prior valuable experience in private equity and other engagements with private companies. It will diversify its portfolio across sectors and different types of enterprises with strict exposure limits. The fund anchors its strategy with a steadfast value approach aimed at mitigating risk.

D.) Investment Committee: The Fund investment committee shoulders governance responsibility for investments, primarily setting policies and providing oversights. The committee shall establish investment guidelines and shall have the authority to exercise those powers relating to the investment management of the corporation’s assets.

Harava Group

Harava Group

(Address for mailing purposes only)